Cryptocurrency is a form of digital currency that doesn’t rely on banks or the government to monitor transactions. Due to cryptocurrency being decentralized, it created a faster path without any additional fees for people looking to get into investing. Crypto allows us to make global transfers to maybe a family member, without the need for verification or other third parties. This can all be done from a person’s cell phone, allowing crucial accessibility that is a great advantage to many people.

Despite the advantages of using cryptocurrency, a recent lawsuit tells a different story.

FTX was one of the many cryptocurrency companies to file for bankruptcy in the last year, leading to thousands of people losing their savings through these investments. It is estimated that customers lost $8 billion in personal savings. The founder of FTX, Sam Bankman-Fried, was recently charged with seven counts of fraud and conspiracy, on the basis of using customers’ investments for personal use.

FTX is not the only cryptocurrency company to file for Bankruptcy, others include Genesis Global Capital, BlockFi, Celsius Network and Gemini Trust. In which all companies in the last two years filed for bankruptcy.

The height of investing in cryptocurrency such as Bitcoin or NFTs became massively hyped during 2021. It seemed like every time people went online there was an influencer doing an ad for some type of crypto, even the Superbowl commercials that year had crypto commercials.

The ads that were used to market cryptocurrency have a specific target in mind: Gen Z, Millennials and mostly men. Male gym influencers, with their large male audiences, were used to promote these ads. Leading to an odd mix of strength and masculinity becoming associated with making money.

The pressure for men to make money by making risky investments has been pushed by society for ages. The average business major will say their favorite movie is “Wolf on Wall Street”, ignoring how badly the story ends.

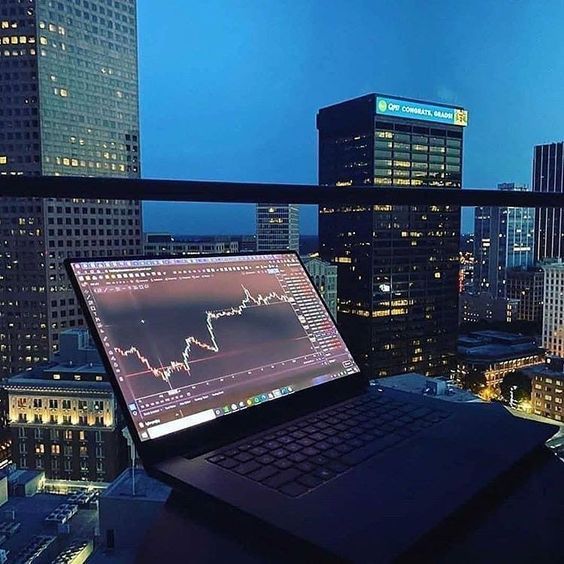

Our current society values the idea of making money in a fast and easy way, especially for men. Investing influencers glamorize this in their content by showing a wealthy lifestyle that was supposedly curated by trading. Promoting the idea that if they can do it, we can too. Leading 20-year-olds who have taken one economics class believe they will all be able to make millions off of amateur trading.

In many ways, it’s great that Americans are motivated to improve their personal financials. However, the overconfidence that financial success is applicable based on influencer ads, led to many people choosing to invest in something that was relatively new to economic markets and underscored the chance of risk with those investments.

Now millions of people have lost money in the cryptocurrency system and are facing the consequences.